Insight: Google “Fusion +CFS”

30 June 2025

Google de-risking and accelerating the fusion industry

Google has signed a power purchase agreement (PPA) with Commonwealth Fusion Systems (CFS), securing 200 megawatts (MW) of carbon-free electricity from ARC1, CFS’s planned first commercial fusion plant to be built in Chesterfield County, Virginia. This represents the latest escalation in technology companies’ strategic pivot to new nuclear as artificial intelligence workloads begin to drive unprecedented electricity demand that traditional low carbon power sources will not adequately address. It also represents a significant vote of confidence in fusion generally, and in CFS in particular. Google’s commitment, covering half of the ARC1’s 400 MW output, is a significant de-risking event for CFS and the fusion industry.

The PPA is too the vanguard of a broader strategic alliance. Google has also secured options to procure power from subsequent ARC series plants, demonstrating a long-term vision for integrating fusion into its global energy portfolio. Michael Terrell, Head of Advanced Energy at Google, articulated the company’s intent: “By entering into this agreement with CFS, we hope to help prove out and scale a promising pathway toward commercial fusion power.” This sentiment was reciprocated by Bob Mumgaard, CEO and Co-founder of CFS, who views the Google deal as “the first of many as we move to demonstrate fusion energy from SPARC.” Alongside the PPA, Google is to make a strategic investment that makes it a “significant shareholder” in CFS – building on its participation in the 2021 $1.8 billion Series B round – further solidifying a symbiotic relationship.

Commonwealth Fusion Systems: the path to commercialisation

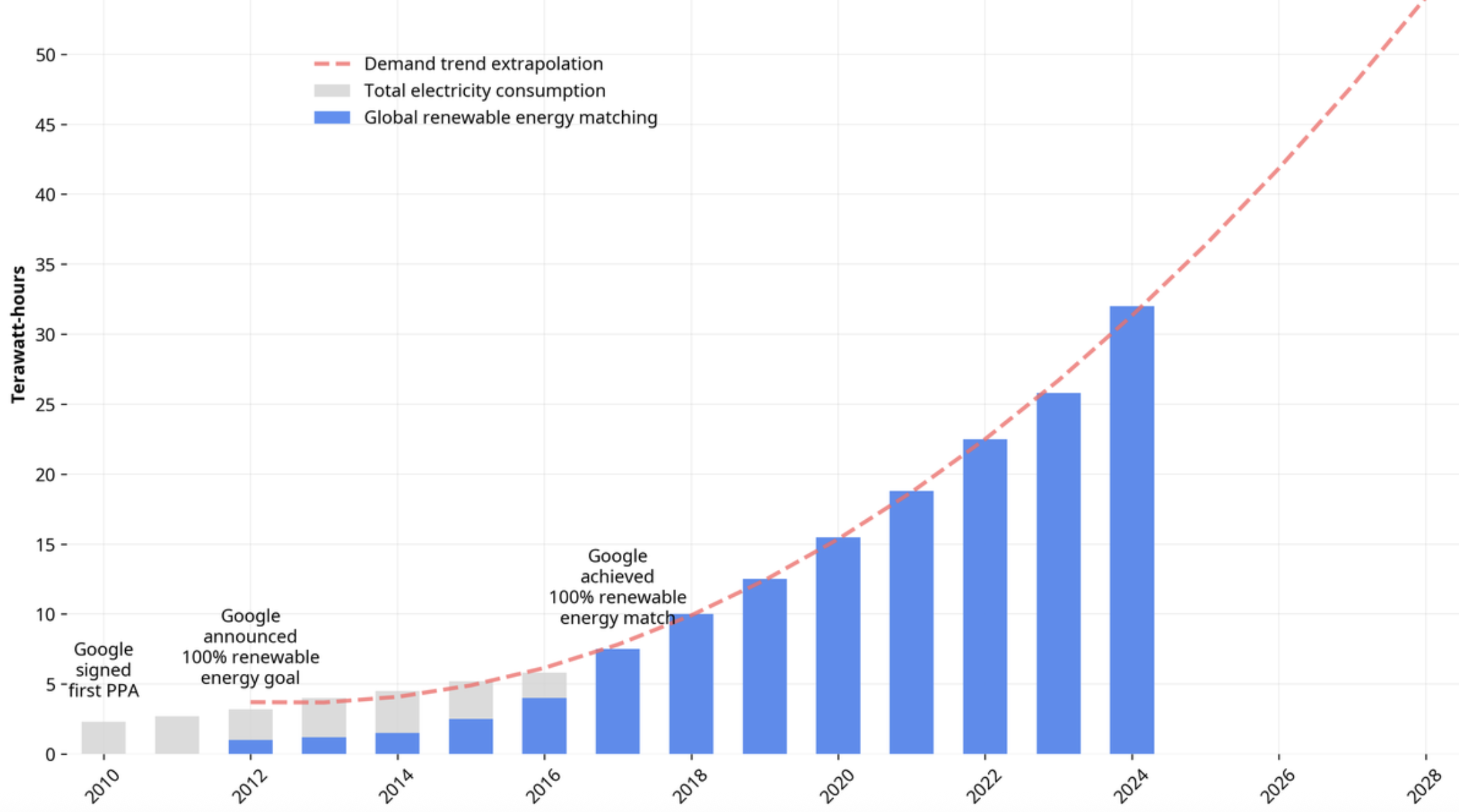

Google’s recently published tenth annual Environmental Report details the company’s approach to managing the growing demand for power. The report highlights this challenge, noting that while Google reduced its data center energy emissions by 12% in 2024, its electricity consumption still increased by 27% year-on-year due to business growth and increasing product adoption, including AI. Global data center electricity demand, which stood at approximately 415 terawatt-hours (TWh) in 2024, is projected by the International Energy Agency (IEA) to nearly double to 945 TWh by 2030, reaching almost 3% of global electricity demand. Goldman Sachs Research forecasts a more rapid increase, with global data center power demand up 50% by 2027, potentially hitting 165% by 2030.

Google’s recently published tenth annual Environmental Report details the company’s approach to managing the growing demand for power. The report highlights this challenge, noting that while Google reduced its data center energy emissions by 12% in 2024, its electricity consumption still increased by 27% year-on-year due to business growth and increasing product adoption, including AI. Global data center electricity demand, which stood at approximately 415 terawatt-hours (TWh) in 2024, is projected by the International Energy Agency (IEA) to nearly double to 945 TWh by 2030, reaching almost 3% of global electricity demand. Goldman Sachs Research forecasts a more rapid increase, with global data center power demand up 50% by 2027, potentially hitting 165% by 2030.

This exponential growth presents a critical operational challenge for hyper-scalers. Power unavailability in many markets stems not from generation capacity deficits but from transmission grid interconnection limitations, making “time to power” a leading consideration for data center site selection. The need to decarbonise and stay decarbonised plus the inherent intermittency of traditional low-carbon energy sources contributes to this challenge, and drives demand for other new dispatchable, high-density, and geographically flexible carbon-free power solutions.

Google’s engagement with CFS reflects this. It is not an isolated venture but a part of a more comprehensive strategy to secure reliable power for its data centers. Google has invested in enhanced geothermal energy, signing the first corporate agreement to develop a next-generation geothermal power project with Fervo Energy in Nevada, which became operational in 2023 and is being scaled up to a larger 115 MW project. The company is simultaneously pursuing small modular reactors (SMRs), as evidenced by its October 2024 Master Plant Development Agreement with Kairos Power for 500 MW of SMR capacity, targeting initial deployment by 2030. Google also has a long-standing research and investment partnership with TAE Technologies which projects net energy generation from its Copernicus reactor before 2030, followed by its first prototype power plant, Da Vinci, in the early 2030s.

However, the PPA with CFS is a significant step forward in fusion. It transcends funding for research, establishing a direct commercial off-take commitment. This provides crucial market validation. Google’s willingness to commit to a technology still in a pre-commercial phase, especially with options for off-take from additional plants, demonstrates confidence in CFS’s approach and its pathway to scalable deployment. The PPA itself provides CFS with a tangible revenue stream from a robust counter-party and a clear market for its future output. Both will be invaluable in attracting the further capital and partners necessary for ARC1’s deployment.

Google’s is too aware of this catalytic role. Its approach actively seeks to accelerate the rollout new power technologies, recognizing their potential to provide consistent, carbon-free power. The Environmental Report states “By procuring electricity from multiple reactors – what experts call an “orderbook” of reactors – we’ll help accelerate the repeated reactor deployments that are needed to lower costs.” By acting as an early adopter and strategic partner, Google is not merely securing its own energy future; it is actively de-risking and accelerating the entire fusion industry. This commitment provides a powerful signal to policymakers, investors, and other potential off-takers, paving what has hitherto been a steepening and stony path to the broader adoption and deployment of fusion technology.

Fusion approach: Magnetic Confinement, Tokamak

Country/Region: USA

Tags: ARC, Commonwealth Fusion Systems, Google, TAE Technologies