Public fusion #1

10 December 2025

U.S. SPAC activity has shown a resurgence, driven not by the broad speculative boom of 2021 but by a selective focus on hard-tech and energy-transition assets. Sponsors with industrial or energy expertise are returning to market, and PIPE investors are re-engaging where the underlying technology has clear regulatory momentum or long-term infrastructure relevance. This shift has coincided with heightened interest in nuclear, which – buoyed by federal incentives, improved public sentiment, and the recognition that decarbonization requires firm, clean power – has re-entered the mainstream of institutional investment.

Within that, fusion chatter has increased with several names frequently cited as potential SPAC or IPO candidates. Type One Energy offers a differentiated stellarator approach; Commonwealth Fusion Systems remains the best capitalized and technically visible innovator, but why go public this early with such access to private capital; and SHINE Technologies, with adjacent revenue-generating isotope et al operations, is probably the most “SPAC-ready” from a commercial standpoint. While technical timelines and execution risk remain substantial, the convergence of renewed SPAC appetite, a bullish nuclear narrative, and fusion’s march to engineering milestones and risk retirement has made a near-term fusion de-SPAC increasingly plausible and one company is doing all the things one might expect of a company striding down that pathway.

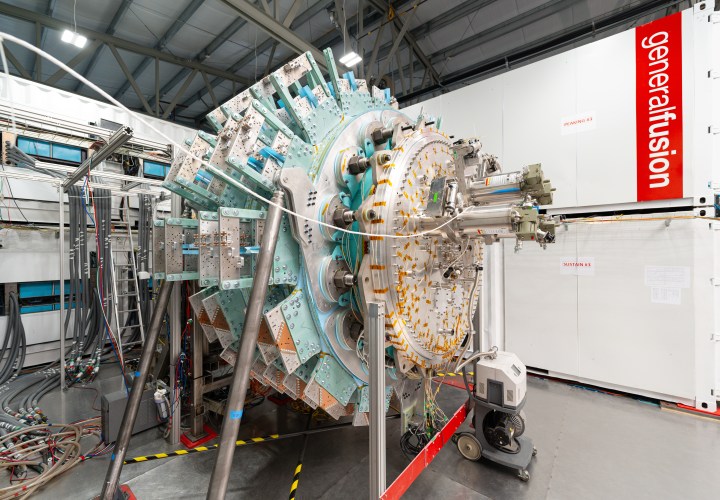

Going first

General Fusion closed a C$51.5 million capital raise late last month. The raise was structured almost entirely through Simple Agreements for Future Equity (SAFEs), with a smaller tranche of common share purchase warrants issued alongside. All securities were sold under the accredited investor exemption. The company issued 67 SAFEs worth C$51.1 million, and 9.1 million common share purchase warrants exercisable at C$2.80 per share, expiring in November 2028.

SAFEs allow General Fusion to receive capital now while avoiding a priced equity round at a moment when it remains in the shadow of its funding crunch. SAFEs convert into equity when a qualifying event occurs, typically a new equity financing above an agreed minimum, a sale of the company, or a public listing. Until then, they sit off the cap table and swerve any hard valuation. Unlike convertible notes, standard SAFEs do not pay interest, do not mature, and do not create any repayment obligation, which amplifies the downside if no trigger occurs.

The warrants, although modest in notional value, provide high leverage and optional upside if there is both liquidity and share price above C$2.80. The combination is typical of bridge financing in capital-intensive sectors: investors accept deferred valuation in exchange for contingent equity rights and the possibility of enhanced returns if the company achieves whatever is viewed as success.

South of the border

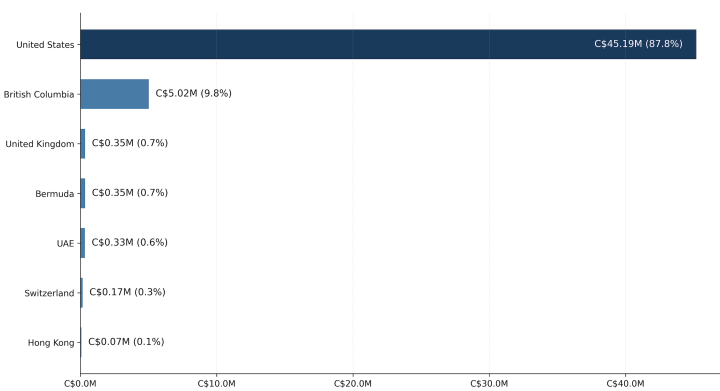

The investors were located in British Columbia, the UK, Bermuda, Switzerland, the UAE and Hong Kong, but of the 67 purchasers, 58 were US-based, contributing approximately 88% of total funds raised. The concentration of US funding is striking for a Canadian technology company given both the historic make-up of the company’s funders and comments from their CEO only this summer about the US and its complications. The absence of a broker and the single-day exempt distribution suggest the raise was relationship-driven rather than broadly marketed, consistent with a tight group of existing supporters or pre-identified institutional investors who were prepared in advance and required limited diligence. In this instance, there are indications that specialist advisors have been engaging with US investors for several weeks, although no bank has publicly identified itself as acting for General Fusion. And neither that activity, nor the raise itself, demonstrates that a US listing is envisaged. Nonetheless, the concentration of US capital is consistent with a company that may be re-orienting southwards and preparing for a future valuation event there.

That investors are embracing an instrument that defers valuation until a later event, and paying for the option of upside from some future event, rests on confidence something is afoot. SAFEs carry little appeal if the company is expected to remain private and illiquid for years. Warrants are only interesting if there is a reasonable prospect of liquidity and a price above the strike. Taken together, it seems a crystallising event lies not too far ahead.

Not crystal clear

It was only in August that General Fusion was celebrating its escape from its funding crunch, and insiders were openly expressing hope that the next milestone would open the door to a public offering. The structure of this raise is compatible with a public listing, particularly a SPAC merger (though neither filings, nor the company, have publicly stated such an intention).

In the event of a public listing, valuation would be set through the market or merger agreement, at which point the SAFEs would convert as agreed, and the warrants would offer upside above a strike price. Such an approach allows a company to maintain runway, avoid a down-round valuation in private markets, and leave price formation to a future transaction. The timing can avoid the need to price the company in the aftermath of a difficult period, when private valuations might be somewhat cautious. This architecture is familiar from recent SPAC-bound transactions in deep‑tech and advanced energy sectors. In those deals, companies have bridged the gap between late‑stage private funding and the public markets using short‑term convertible or pre‑IPO instruments and have come to market with layers of warrants designed to reward investors who funded the period immediately before the listing, although the exact structures, instruments and terms vary by deal.

A raise of this type, at this moment, with this investor mix, reads like a financing that buys time through to a transaction rather than one that establishes a new long-term private valuation. Canada’s Globe & Mail this week quoted David Barr, CEO of PenderFund saying they invested in the $22m ‘pay-to-play’ round this summer “with the understanding the company would look to go public as soon as possible” and calling this latest deal a “crossover financing to further support the company’s go-public endeavours.” There is also increasing chatter across the sector that US SPAC deals in 2026 are being explored, and SPACs more broadly are back in a big way in the US, where several fission deals are being plotted. Though nothing is confirmed in fusion, a SPAC deal could offer speed, valuation set-through-negotiation rather than private market precedent, and a ready pool of US capital. The financing structure just completed is compatible with that process.

And it is a process: a SPAC with a target will need to identify and anchor PIPE investors, ensure they have cash to cover potential redemptions, sign a merger agreement with the target, obtain shareholder approval, and close the merger (de-SPAC). Which makes Segra Capital Management interesting. Segra has anchored multiple nuclear‑sector SPAC financings, including leading a $m PIPE (plus a $m bridge facility) for Terra Innovatum/GSR III’s proposed SPAC merger, and participating in the 235m PIPE raised alongside the NuScale Power/Spring Valley de‑SPAC in 2022. And they just raised more than $45m for Segra XE 2, LP, as disclosed in an SEC Form D filing. This most recent filing was made days prior to General Fusion‘s C$51.5m financing round. That sequence is notable: a crossover round days after the funding of a $45m Segra vehicle is consistent with de-SPAC preparation, in which a target engages investors via SAFEs while an anchor investor raises a dedicated pool of capital that can later be deployed to offset SPAC redemptions and help satisfy minimum cash conditions.

Investor calculus

For investors, the calculus is straightforward, the decision economically rational: if it works, they receive shares at a discount to whatever valuation emerges in a public listing. The instrument rewards those willing to provide capital when alternatives are limited and timing urgent. But the structure also carries material risk. The use of SAFEs, rather than pre-IPO securities such as convertible notes, signals confidence in a trigger for equity conversion. Standard SAFEs have no maturity date, pay no interest, and create no debt obligation to provide downside protection. If no triggering event occurs the SAFEs remain unconverted, and investors hold an instrument that never transforms into equity and is never repaid. Even in a liquidation or wind-down, SAFE holders typically rank below debt but above common stock, though in practice there is often little left by that stage. The bet on the SAFEs is near binary: either a liquidity event materializes and the instruments convert on favourable terms, or the company remains private and the capital is effectively stranded.

The warrants offer additional upside if the stock trades above C$2.80. These may have been offered as an incentive to investors, especially those willing to go big, but warrants are also often used by companies seeking to preserve cash, to part-compensate the sort of well-paid advisors – boutique investment banks, legal advisers and so on – one needs to get this type of thing over the line.

The willingness of investors to provide funds to a company that has been operating since 2002, on instruments with no guaranteed return implies either deep confidence in an imminent exit or a recognition that their alternatives were narrower still. Many investors entered at lower valuations years ago but likely saw paper gains squashed in the recent ‘pay-to-play’ down-round. The terms likely offer discounted conversion (and perhaps warrant upside) in exchange for taking on the risk of a stranded instrument. A near-term public listing would deliver both conversion and exit, potentially recovering any value that had been written down in private markets and then some. For longstanding investors, those that are a perhaps past the excitement and novelty of fusion or who remain somewhat nervous given the events of the summer, that’s attractive and wholly rational.

So, a raise of this type, at this moment, with this investor mix, reads like a financing that buys time through to a transaction rather than one that establishes a new long-term private valuation. If a listing occurs, the SAFEs convert, the warrants deliver upside, and General Fusion gains access to liquidity, visibility, and a deeper pool of capital. Add in a close-run summer, a pressured raise that likely provided enough cash for a few months, public statements from those close to General Fusion talking-up public listings, and increasing chatter across the sector that a US SPAC deals in 2026 is being explored, and the odds on General Fusion being first to go public have shortened dramatically.

That said, no transaction has been announced.

Fusion approach: Magnetized Target Fusion, Pulsed Magnetic Fusion

Country/Region: Canada

Tags: General Fusion, PenderFund, SAFEs, Segra Capital Management, SPAC, Warrants