General Fusion: still swinging

28 August 2025

LM26 has 10 months to prove the path forward

General Fusion has survived the standing count. The company is back in the fight but remains toe-to-toe with that seasoned veteran, cash-flow reality. While their recent $22m funding round has returned them to the center of the ring, tough rounds – both metaphorical and literal – lie ahead.

In May, General Fusion went public about its precarious position. CEO Greg Twinney published an open letter pleading for investment, the company was forced to reduce its workforce by at least 25% to preserve cash, and survival mode became the operational reality. Several weeks passed before chatter of a successful raise, supposedly at a sharp discount though details were scarce as the company focused narrowly on the existential task at hand.

The announcement of a $22 million raise in recent days brought relief. The mood lifted, pre-written obituaries speaking of silenced pistons returned to the drawer, faces turned back toward the sun, clouds cleared revealing the path to the sunlit uplands. But it’s a steepening path, and it’s perilous in places.

Time Bought

General Fusion’s LM26 is designed to prove the company’s Magnetized Target Fusion (MTF) technology aiming at a series of milestones: 10 million degrees Celsius (1 keV), 100 million degrees Celsius (10 keV), and “scientific breakeven equivalent in a commercially relevant way”. Scientific breakeven equivalent means achieving with D-D, the temperature, density, and confinement time that would have given a Q=1 outcome had it been fuelled with more reactive D-T. Successfully executing this roadmap would position the company to deliver fusion power to the grid by the early to mid-2030s and capture a share of the multi-trillion-dollar market opportunity.

The funding figures reveal the extent of General Fusion’s challenges. Reports in Canada’s national newspaper, The Globe and Mail, noted the company had sought $125 million, the sum need to complete the LM26 program through to scientific breakeven equivalent. The company secured $22 million, from a round it maintains was “sized to raise the funds necessary to get the company to its next technical milestone (1 keV) and streamline the cap table and was oversubscribed”. Nonetheless, the round signalled some investor reluctance. It was described as “pay to play” and closed only with some meaningful carrots and sticks. David Barr, CEO of PenderFund Capital Management said his firm put nearly $5 million in the round which increased its stake to 11% from 3% and gained a board seat. Several longstanding investors, including GIC and Temasek, took it on the chin. While Adam Rodman, chief investment officer at Segra Capital, characterized the raise as “the least amount of capital possible” to get the company to its next 1 keV milestone.

Time Limits

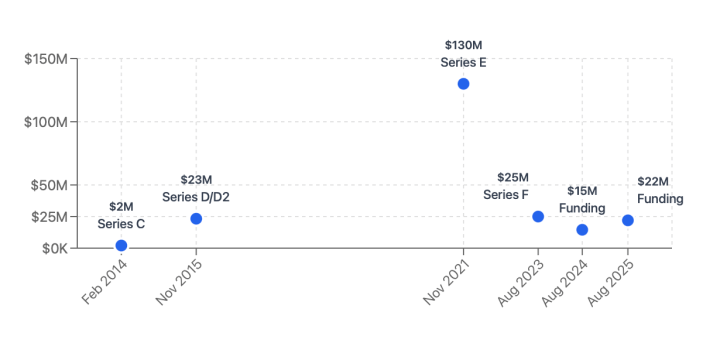

General Fusion’s funding history suggests a historical monthly burn rate approaching $2 million. This has been tightened meaningfully more recently. The company raised $25 million in their Series F round in August 2023, followed by a $15 million bridge round in August 2024, but by May 2025 was in financial difficulty, taking difficult decisions and being candid about its challenging position. Assuming at this point it had perhaps less than $5 million remaining at hand, the company had spent approximately $34 million over 21 months, pointing to a monthly burn rate of some $1.6 million.

With an additional $22 million secured – and a burn rate cut to $1.4 million following workforce cuts, streamlining, and a tighter operational focus – a basic reckoning shows General Fusion has time but remains in an uncomfortable position. The numbers suggest the company has a runway to the end of 2026, approximately 16 months. However, they must hit their next milestone well before then to leave sufficient time to leverage it for new funding.

|

Period |

Funding Raised |

Cash Consumed |

Monthly Burn |

Remaining Cash |

Key Events |

|

Aug 2023 – Aug 2024 |

$25.0M (Series F) |

~$20.8M |

~$1.6M |

~$4.2M |

Series F funding |

|

Aug 2024 – May 2025 |

$15M (Bridge) |

~$14.4M |

~$1.6M |

~$4.8M |

Bridge funding, workforce cuts |

|

May 2025 – Aug 2025 |

$0 (Crisis period) |

~$4.2M |

~$1.4M |

~$0.6m |

Existential mode, fundraising |

|

Aug 2025 – Dec 2026 |

$22.0M (‘Pay to play’) |

~$22.4M |

~$1.4M |

~$0.2M |

1keV milestone, fundraising… |

Milestones

General Fusion’s immediate future depends on executing technical milestones over the next 8-10 months. The primary challenge now nailing the next milestone to reassure and reinvigorate funders. With additional funding secured, the company can then continue on their current path with LM26 and build support for sustained capital flows through subsequent milestones toward commercialization.

Despite financial constraints, General Fusion has maintained technical momentum. The May 2025 workforce reduction affected roughly 25% of the company’s 140 employees but maintained the essential development team and preserving critical expertise. LM26 has advanced steadily in recent months: on February 14, they achieved first plasma as planned; on April 29, they announced they had achieved their first successful compression of a large-scale magnetized plasma using a lithium liner. Their fully integrated LM26 system and diagnostics have operated safely and as designed, and early data review indicate positive results. The program is significantly de-risked.

The next milestone is 10 million degrees Celsius (1 keV), the company has some $22 million to get there. The hope is that news of 1 keV will unlock the capital required, especially from new investors, to drive at 100 million degrees Celsius (10 keV), then hit scientific breakeven equivalent, and cement General Fusion among the lead group of favoured approaches to commercially-viable fusion.

Nonetheless, the company operates in an increasingly competitive fusion energy sector. The CEO described a “funding landscape more challenging than ever as investors navigate a rapidly shifting and uncertain political and market climate”. For General Fusion, this challenge is reflected in declining round sizes – from a total $130m in their Series E to $25 million from their Series F and $22 million in the latest round – and shortened intervals between funding events.

The broader fusion investment landscape is too dynamic. Capital flows to fusion are growing but so too are both capital needs and the number of companies seeking to build commercially relevant fusion machines. Questions remain about eventual consolidation in the sector, likely investor focus on fewer and favored approaches, the place for elegant but innovative technologies like that of General Fusion in this, plus the relative advantages of ‘national champions’ and the strength of their access to consistent, public-sector support.

The broader fusion investment landscape is too dynamic. Capital flows to fusion are growing but so too are both capital needs and the number of companies seeking to build commercially relevant fusion machines. Questions remain about eventual consolidation in the sector, likely investor focus on fewer and favored approaches, the place for elegant but innovative technologies like that of General Fusion in this, plus the relative advantages of ‘national champions’ and the strength of their access to consistent, public-sector support.

The company has weathered difficult rounds before. General Fusion remains in the bout and still aims for gold. They’ve absorbed some hits, streamlined operations, and refocused on the essential milestones that will determine their future. The $22 million raise provides sufficient time to demonstrate their technology’s potential, though whether the next set of results will be sufficient to unlock the substantial financial backing all fusion companies will require remains to be seen.

The bell isn’t rung yet, and they’re still throwing punches. Seconds out…

Lead investors: Pender Fund, Segra Capital

Fusion approach: Magnetized Target Fusion, Pulsed Magnetic Fusion

Country/Region: Canada

Tags: General Fusion, PenderFund, Segra Capital