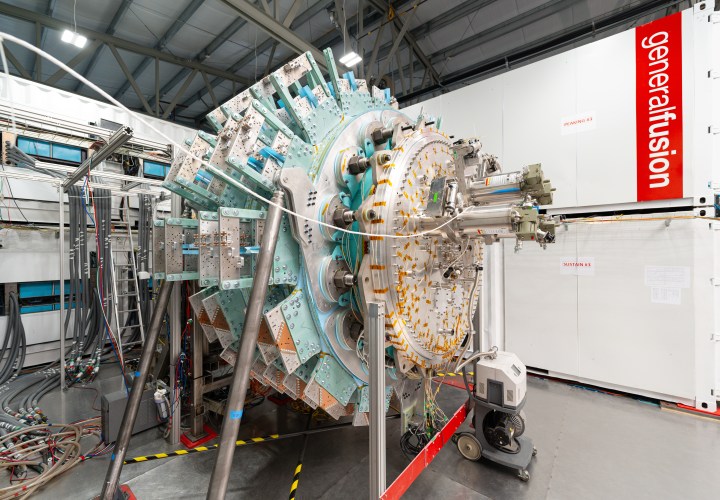

General Fusion: seeking bold investment to drive MTF to 10 keV & breakeven

3 June 2025

Advancing, restructuring & willing to explore all options

Late last month, General Fusion‘s CEO Greg Twinney wrote an open letter speaking of “unexpected and urgent financing constraints” and seeking additional funding to enable the company to complete its LM26 demonstration reactor program, to reach scientific breakeven, and drive on to commercialisation.

General Fusion has received some $350 million in equity finance since its founding in 2002 – including a US$22.7 million round that closed in July 2024 – plus significant support from the Canadian state entities including most recently both Canadian Nuclear Laboratories (CNL), Canada’s premier nuclear science and technology organization, and the Business Development Bank of Canada’s investment arm, BDC Capital. However, Twinney described a “funding landscape more challenging than ever as investors and governments navigate a rapidly shifting and uncertain political and market climate.”

FusionX spoke with the company about its achievements, milestones, funding needs and expectations. General Fusion is possibly at an existential moment, but is still punching and intends to explore all options to continue their mission to change the world.

The LM26 machine has achieved several key milestones in early 2025, including plasma formation and compression with lithium. Could you elaborate on how those technical achievements compared to your initial projections for the timeline?

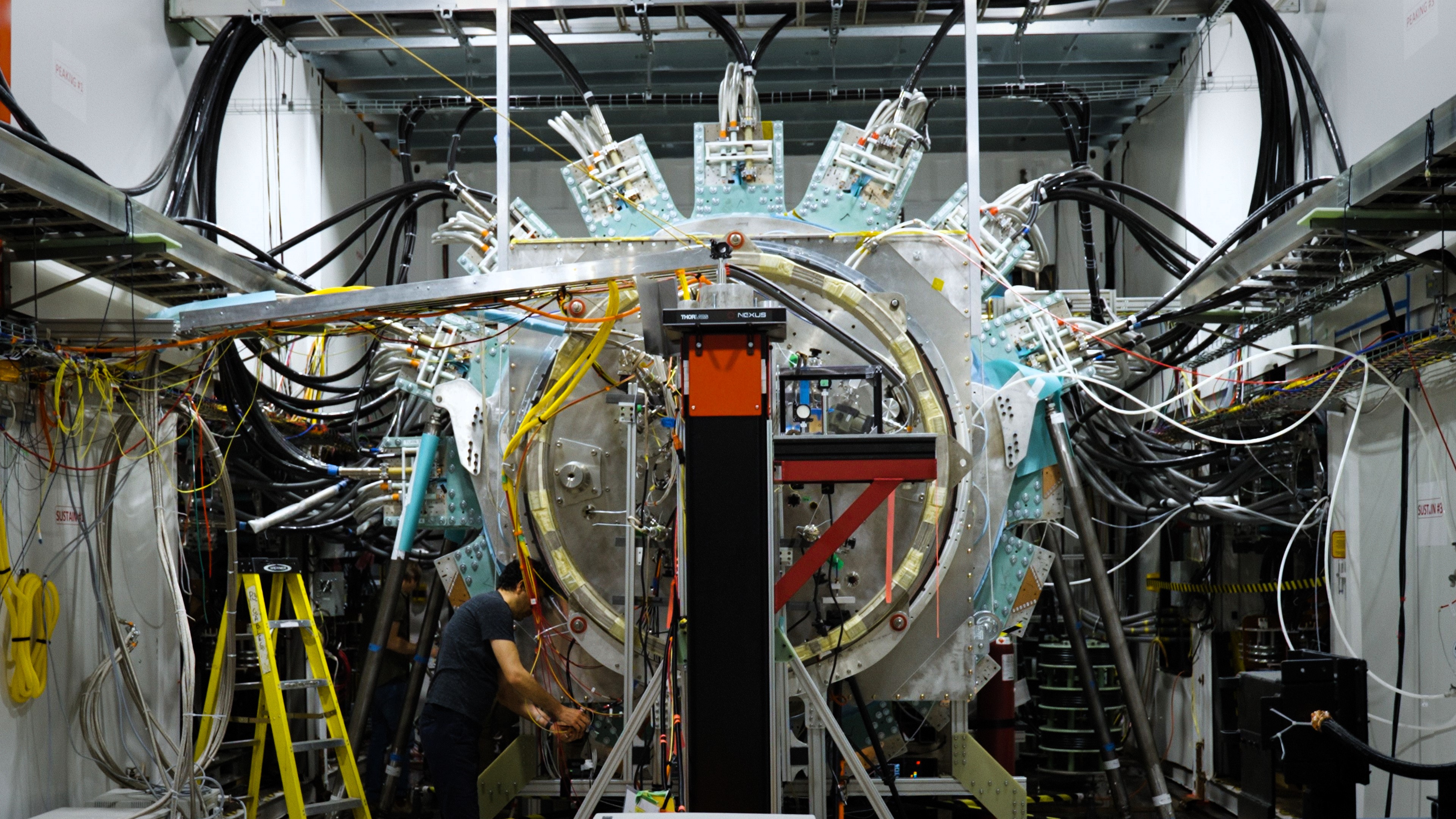

Simply, we’ve been on time and on budget. In about a year and a half, we designed, built, and started operating LM26.

On February 14, we achieved first plasma in LM26, as planned. On April 29, we achieved a key milestone, successfully compressing a large-scale magnetized plasma with lithium, again as planned. The full, integrated system and diagnostics operated safely and as designed. Early review of data indicates positive results.

LM26 positions us to put fusion power on the grid by the early to mid-2030s and own a trillion-dollar market. It is designed to achieve a series of results that will demonstrate our Magnetized Target Fusion (MTF) technology: 10 million degrees Celsius (1 keV), 100 million degrees Celsius (10 keV), and scientific breakeven equivalent (100% Lawson) in a commercially relevant way.

We have the machine to be the first in the world to demonstrate commercially relevant fusion – we built the racecar. Now we need to fuel it through investment.

Your peer-reviewed publication confirmed achieving energy confinement times exceeding 10 milliseconds. What technical hurdles remain between your current state and achieving the 1 keV and 10 keV temperature thresholds targeted for 2025-2026?

We are one of only four private fusion companies in the world to have achieved, and published, meaningful fusion results on the path to scientific breakeven. These were published in the 2024 and 2025 issues of Nuclear Fusion. The most recent publication proved our ability to achieve energy confinement times exceeding 10 milliseconds, the energy confinement time required to achieve our targeted milestones in LM26. Our paper on our Plasma Compression Science campaign showed that when a plasma was compressed, neutron yield increased significantly, exceeding 600 million neutrons per second. These results significantly de-risked our LM26 program. As a result, we are very confident that we will achieve our targets with the machine, using a phased approach for each of our targeted milestones. The main hurdle now is the capital required to continue to execute our planned program.

We are one of only four private fusion companies in the world to have achieved, and published, meaningful fusion results on the path to scientific breakeven. These were published in the 2024 and 2025 issues of Nuclear Fusion. The most recent publication proved our ability to achieve energy confinement times exceeding 10 milliseconds, the energy confinement time required to achieve our targeted milestones in LM26. Our paper on our Plasma Compression Science campaign showed that when a plasma was compressed, neutron yield increased significantly, exceeding 600 million neutrons per second. These results significantly de-risked our LM26 program. As a result, we are very confident that we will achieve our targets with the machine, using a phased approach for each of our targeted milestones. The main hurdle now is the capital required to continue to execute our planned program.

How will staff reductions affect your technical capabilities and these timelines? Have you been able to maintain your core development team and preserve essential expertise?

Our team has always been lean and nimble. We’re a mission-driven organization with dedicated employees, so losing any of them is meaningful. However, we took action quickly to protect our IP and core technology while we raise capital. If we go back to the race car analogy, we’ve slowed the car down, and with the right financing we’ll be ready to accelerate forward again and take the lead in the fusion race.

Beyond direct tariff impacts, how have these trade tensions affected investor sentiment toward Canadian-based technology companies? Have potential US investors expressed specific concerns about cross-border operations?

The geopolitical and economic environment is difficult right now, including U.S.-Canada trade relations, and this causes financial uncertainty for both investors and governments. Because of that, investors are stepping back and moving a lot slower than they did previously. This is amplified in deep-tech and longer-term ventures such as General Fusion. In this environment, some US investors are certainly retreating geographically and asking questions about US presence. We’re proud to be a Canadian company, with a fusion demonstration machine that is up and running—something most other private fusion companies cannot claim. However, we are in a global race. Part of our message to investors is we’re broadly flexible in terms of structure and the future of the company.

You’ve indicated needing US$125 million to maintain core LM26 operation through the next milestones, is that correct? How was this figure calculated, and what specific operational timeline does it support?

With every milestone we achieve, we build value for investors. A relatively small investment now will have a big impact in the near term and get us to our first milestone—10 million degrees Celsius of heating from compression.

In the next two years, our plan is to get to scientific breakeven equivalent (100% Lawson) with another US$125 million, an order of magnitude less than competitors raising billions to accomplish the same goal. Because our technical advancements are planned in stages that build upon each other, we will unlock major value for investors over the next few years as we execute on our technical roadmap.

Has the shift in US administration and subsequent trade tensions affected any potential US-based partnerships or funding sources you were pursuing?

We’re advancing our MTF technology in partnership with several top labs and universities in Canada, the UK, and the U.S. In the U.S., for example, through the Department of Energy’s new FIRE Collaboratives program, we’re excited to expand our collaboration with Savannah River National Laboratory to advance the fusion fuel cycle and testing capabilities and work with Idaho National Laboratory to accelerate tritium breeding R&D. We are also participating in programs such as the U.S. Department of Energy’s Private Facility Research Program, to support the broader fusion research community. Through the PFR program, public researchers can apply to conduct open peer-reviewed science at private fusion facilities, including on LM26 at our B.C. facility.

However, geopolitical uncertainty creates uncertainty in financial markets, which trickles down to risk aversion. Additionally, U.S. government funding generally requires that work be done in the U.S., and while we work with a number of U.S. partners, we are a Canadian company and our LM26 machine is in Canada, which limits U.S. government support and has an impact on U.S. investment.

Your patent portfolio reportedly includes well over 100 patents. How defensible is this IP position, and have you explored licensing opportunities as an additional revenue stream during this funding constraint period?

Today we have a strong, highly defensible portfolio of 190 patents. Part of this restructuring is taking action to protect our future with our game-changing technology and IP. We’re doing what resilient teams do and what we have done before: refocus, protect what matters, and keep building.

How are potential investors weighing the progress of LM26 against competing fusion technologies that have also announced ambitious timelines for commercial deployment in the early 2030s?

What sets General Fusion apart is that from the outset, our MTF approach was designed to overcome the known challenges of commercializing fusion, not just demonstrate the science. MTF is an elegant solution that uses a liquid lithium liner to perform many of the functions of a fusion machine: first wall, breeding blanket, and heat transfer medium. General Fusion’s MTF sidesteps the four major barriers that other approaches will face when moving from demonstration to commercialization. A General Fusion MTF power plant will produce economical fusion energy with a durable and reliable machine, sustainable fuel production, and the means to extract and put that energy to work.

What sets General Fusion apart is that from the outset, our MTF approach was designed to overcome the known challenges of commercializing fusion, not just demonstrate the science. MTF is an elegant solution that uses a liquid lithium liner to perform many of the functions of a fusion machine: first wall, breeding blanket, and heat transfer medium. General Fusion’s MTF sidesteps the four major barriers that other approaches will face when moving from demonstration to commercialization. A General Fusion MTF power plant will produce economical fusion energy with a durable and reliable machine, sustainable fuel production, and the means to extract and put that energy to work.

General Fusion has always stood out in our ability to execute and iterate quickly. Our timeline estimates are based on results from real, operating machines. After we achieve LM26’s targets, the path to commercial fusion is shorter using our approach, as we’ve front-loaded the work to overcome the barriers to commercialization. This is a major opportunity for investors in terms of valuation and returns.

If the additional funding is secured, what specific technical milestones would you prioritize to demonstrate progress to investors and strategic partners?

We’d continue on our current path with LM26 – we have an investable roadmap that builds investor value as we prove important technical milestones in fusion. The machine is designed to achieve a series of results that will demonstrate MTF: 10 million degrees Celsius (1 keV), 100 million degrees Celsius (10 keV), and scientific breakeven equivalent (100% Lawson) in a commercially relevant way.

As we mentioned, our first plasma compression shot last month was a success. Now we’re busy preparing for the next one!

What timeline adjustments might be necessary if the current funding constraints persist beyond Q2 2025? Is there a “minimum viable program” that could maintain core capabilities with significantly reduced funding?

We are developing MTF in a way that is more commercially viable and addresses the barriers to a practical fusion power plant than other approaches – that is what makes MTF so special. We can bring fusion to the grid by the early to mid-2030s. From inception, it was designed to scale for cost-efficient power plants by sidestepping the four pitfalls or barriers of other approaches: machine durability, fuel production, energy conversion, and commercial economics.

Our path to powering the grid with fusion energy is more straightforward than other technologies—because we have front-loaded the work to address the barriers to commercialization. The strong economics and commercialization advantages underpinning our approach are a big part of why they invest. We are also very efficient with our investors’ capital; we are constantly thinking about risk retired per dollar spent. As a result, we expect to get electricity on the grid at a fraction of the cost of other programs and drive significant value for our shareholders. General Fusion’s LM26 program is already demonstrating measurable technical results in a shorter timeframe, at a fraction of the cost, and with incremental funding.

Given the challenging fundraising environment, have you explored potential exit opportunities or strategic acquisition scenarios?

We are open to all strategic options to carry out our mission to change the world, including a sale of the company. We are restructuring – doing whatever we have to do – to make practical fusion power a reality. That’s how important this is. The future is bright for fusion, but we’re short on time. With significant capital already deployed to advance our technology and build LM26, this is a huge opportunity for bold new investors in terms of valuation and growth potential.

Fusion approach: Magnetized Target Fusion, Pulsed Magnetic Fusion

Country/Region: Canada

Tags: General Fusion, LM26