East X Ventures Launches “Starmaker One” Fusion Fund

24 April 2025

East X Ventures has launched “Starmaker One,” a private investment fund dedicated to fusion with a £20m cornerstone investment from the UK government through the Department for Energy Security and Net Zero (DESNZ), and a further £20m investment from their parent company East X. On revealing their own investment in Starmaker One, East X said: “Fusion energy represents one of the most transformative opportunities in the global energy landscape and is rapidly emerging as one of the century’s most strategically important technologies.”

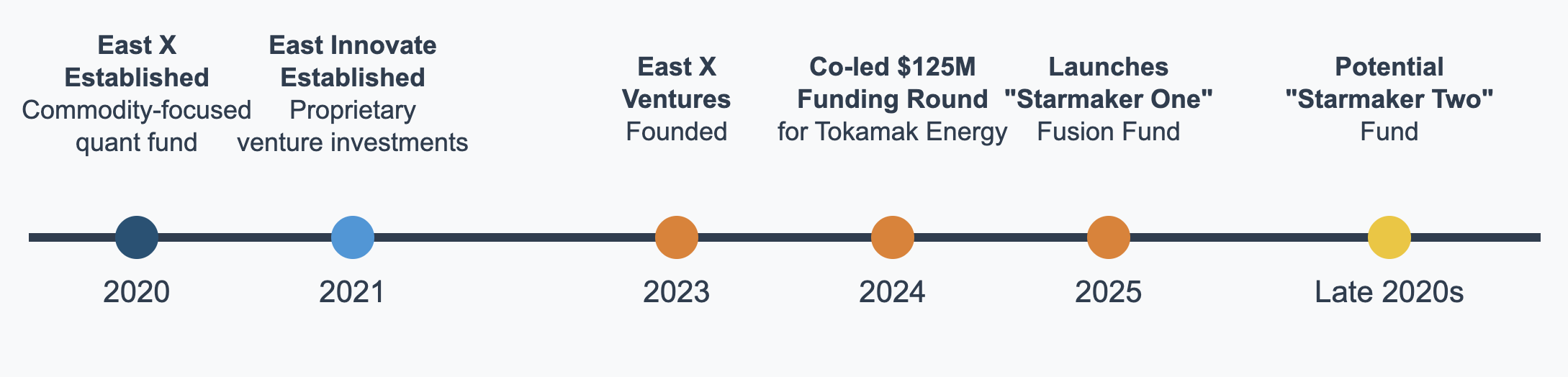

East X is a London-based, commodity-focused quantitative investment firm, established in 2017 and focused on commodities, energy & power. In 2021, the company established East Innovate to focus on venture investments in disruptive tech for those markets, leveraging their knowledge of the commodity and energy supply chain. A significant proportion of East Innovate’s investments were fusion or fusion-related. East X Ventures was established to pursue similar fusion-related opportunities while also managing third-party capital. East X Ventures already boasts investments in NT-Tao, digiLab, Luffy AI, and Mach 42, and in November 2024, co-led a $125m funding round for Tokamak Energy alongside Lingotto Investment Management. That investment supported Tokamak Energy’s commercialization plans and the growth of its TE Magnetics division, which develops high-temperature superconducting technology.

Rory Scott Russell, General Partner at East X Ventures, is an advisor and board member of several early-stage technology companies, including fusion systems companies, fusion spinouts, and suppliers to the emerging fusion ecosystem.

Starmaker One will focus on early-stage fusion technologies, encompassing both enabling technologies for fusion energy and spin-out technologies with non-power applications. At present, some 20 opportunities—mostly supply-chain and mostly UK-based—are being actively explored. It is expected that they will build a portfolio of 20-30 investments with a portfolio mix of roughly 50/50 supply-chain vs spin-outs.

While Scott Russell acknowledges opportunities in the US, Europe, and Asia, he thinks the UK is underserved by good VC and in venture you need to be hands-on and close to portfolio companies’ teams. He added, “Of all deep-tech, fusion energy ex-US has the lowest level of VC funding,” emphasizing too that “the UK is a world centre of fusion research, Culham is a boiling cauldron of opportunity.”

The UK government’s £20m investment represents a novel deployment of public-sector capital into an early-stage venture capital fund. It also secures strategic benefits by supporting the growth of the fusion sector and related technologies in the UK. Scott Russell said the UK Government’s role was that of a typical LP, they had simply been first to embrace the fund’s investment thesis.

According to Scott Russell the fusion ecosystem is well defined, there are a number of clear problems and few providers of solutions. He envisaged this dynamic eventually giving rise to liquidity opportunities or exits through, for example, consolidation as larger incumbents seek control of segments of the supply chain and associated IP necessary to their path to commercialization. He also pointed to the prospect of accessing the public markets for companies that carve out strong positions with deep moats by becoming early and key suppliers to the emerging fusion industry, including both large public projects and private sector companies, and to other industries with non-power applications.

Looking forward, Scott Russell said “The intention is to grow in lock-step with the industry as a whole,” adding there is the potential for a substantially larger fund, Starmaker Two, “When the industry’s technical success and markets warrant further capital.” At that point, a Starmaker Two could focus on both growth & early-stage opportunities and likely be significantly more international in terms of both capital and investments.

Country/Region: UK

Tags: East X Ventures, Free to Public, Starmaker One