Our top two predictions for 2026

5 January 2026

We could join the crowd with a half-dozen, hedged and nuanced predictions in the form “no private sector q>1 but lots of advancements” and so on. We offer, however, only two. But a bold and big two. Bookmark them now.

1. Total funding to ‘private sector’ fusion to top $20bn

There are many ways to reckon the total funding to private sector fusion and (despite our confidence in maintaining the most comprehensive and accurate fusion funding data set) FusionX generally leads with the most conservative: equity investment received by private-sector fusion, excluding China.

Our reasoning is that ‘cash received’ is meaningfully more valuable. It is certain, available, and earning interest, while ‘cash committed’ is not. Further, we hold that the ‘private’ fusion sector in China cannot be directly compared to that elsewhere, it is structurally different: state-owned, state-controlled, state-directed and held in a research, funding, governance, and regulatory lattice that constrains any action not aligned with state objectives.

By this conservative reckoning, the fusion sector raised $2.5 billion in 2025, representing a 127% year-on-year increase. It was behind the 2021 record of $2.9 billion, but the second-highest annual total since the start of our data set. Cumulative funding for the entire private fusion sector hit $9.55 billion, a 1.92x increase 2021’s $4.97 billion.

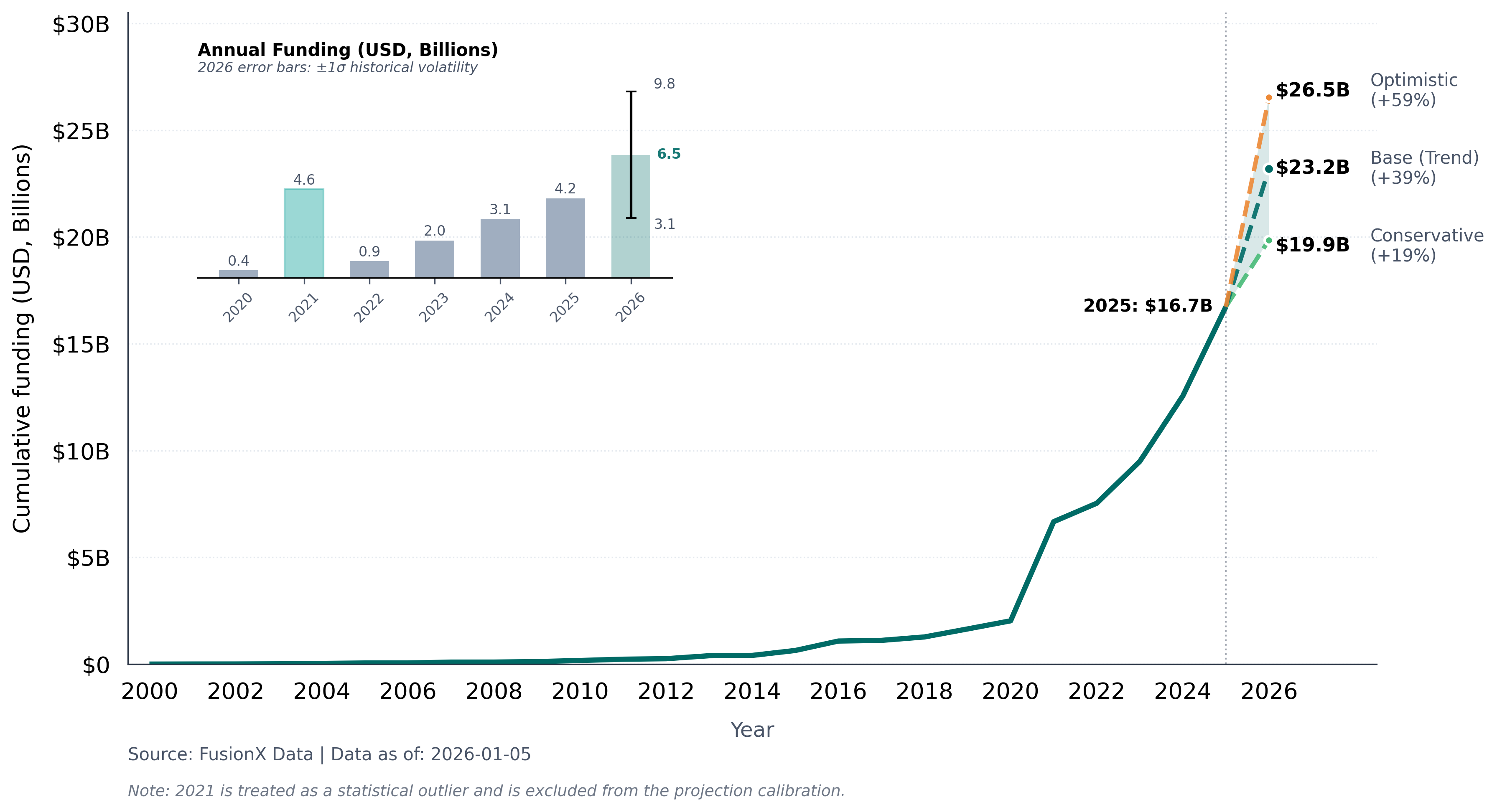

However, an expansive, full-fat, funding total (equity and non-dilutive, committed and received, including ‘private sector’ China) saw $4.2 billion raised in 2025 and cumulative funding hit a whopping $16.7bn. If we consider the CAGR underpinning this, even excluding 2021 from volatility calibration as a statistical anomaly (record-low interest rates, the COVID afterclap, Helion’s conditional $1.7bn announced then but mentioned little since), we get a 10-year CAGR of 38.6%. That momentum alone suggests a total at end-2026 in excess of $23 billion.

Fig 1. Full-fat fusion funding, actual to end 2025 & forecast to end 2026

This seems a huge number but, there are real world factors driving funding growth: public market access for fusion companies; geopolitical aims of technological leadership in both China and in the US, and of energy sovereignty in Europe; the broadening pool of willing capital providers; and, on the sell-side, the maturity of fusion companies and their increasing capital needs.

That said, and though we think 2026 is set to be a near record year, given part of our mission is to remain sober and where needed calm the boosters, we focus on the $19.9bn conservative scenario, one standard deviation from the Core.

FusionX reckons the fusion sector’s full-fat funding (equity and non-dilutive, committed and received, including China) is positioned to hit $20 billion in cumulative funding by end-2026.

2. Three (or more) fusion companies in the public markets

Fusion is already accessible through the public markets. IP Group PLC (LSE: IPO.L) holds approximately 25-35% of First Light Fusion. However, with fusion representing only 10-15% of its total assets, an investor purchasing IPO.L would have 2.5-5% of their investment exposed to fusion. Similarly, Baillie Gifford’s Edinburgh Worldwide Investment Trust (LSE: EWI.L) holds SHINE Technologies, where it represents 1-3% of a diversified portfolio including SpaceX and numerous other holdings, giving an ultra-diluted, less than 1%, effective allocation to fusion.

With the existing public paths unable to provide meaningful investor participation in the fusion sector’s growth, TAE Technologies’ expected move to the public markets is a watershed moment. The company’s proposed merger with Trump Media & Technology Group, announced in December 2025 and valued at more than $6 billion, will likely create the world’s first publicly-traded fusion company upon closing in mid-2026. TAE’s public listing will provide direct stock market access to a pure-play fusion company. The markets seem to like the idea, even if they are still digesting it.

Fig 2. Trump Media & Technology Group’s fusion driven share price spike

TAE will likely (but not certainly) be the first to do so. U.S. SPAC activity has experienced a selective resurgence, driven by focused interest in hard-tech and energy-transition assets with several fusion names suggested as potential de-SPAC targets. FusionX’s examination of recent deals around General Fusion, put them somewhere at the top of that list. Their C$51.5 million November 2025 capital raise, structured almost entirely through SAFEs and warrants, was a bridge-oriented structure, deferring valuation to a liquidity event while providing investors contingent equity rights familiar from recent deep-tech de-SPACs. General Fusion have announced nothing publicly, but PenderFund CEO David Barr was explicit, stating his firm invested “with the understanding the company would look to go public as soon as possible” and characterizing the November raise as “crossover financing to further support the company’s go-public endeavours”.

Within the broader SPAC and fusion landscape, other companies could be seen as positioning themselves as potential public market candidates. And, with the expected success of TAE’s merger, investor pressure on well-funded private companies to provide liquidity, the broadening interest in and strategic importance of fusion energy to national energy security and artificial intelligence infrastructure, and the renewed appetite for selective SPAC transactions in hard-tech and energy sectors we expect the public markets will be very welcoming to fusion in 2026.

FusionX predicts three (and possibly more) fusion companies will be in the public markets by the end of 2026.